Working capital management

Create more financial flexibility

With working capital management (WCM), PostFinance helps companies to improve their liquidity along the supply chain. In addition, PostFinance has also developed an analysis tool, established a research center and awarded the Swiss WCM Award for the first time.

Reminding tardy payers consistently, taking advantage of supplier discounts, investing surplus capital, optimizing inventory levels – simple steps for creating financial flexibility in a company. Many large and medium-sized companies tie up too much capital in work processes. The experienced experts at Swiss Post go to companies to conduct a joint analysis of working capital processes and work together with the customer to develop tailored solutions for improving liquidity, also taking account of process-related and logistical aspects. Swiss Post offers all of the logistics, finance and IT services relevant to working capital management from a single source. These services, unique in Switzerland, allow customers to coordinate processes in a timely fashion, exploit synergies and prepare themselves for future challenges.

Analysis tool developed

Working together with the University of St. Gallen, PostFinance has developed an analysis tool to measure the maturity level of companies in terms of working capital management and to measure the potential for optimization. The tool helps experts in an organization to identify strengths and weaknesses and to develop measures in response.

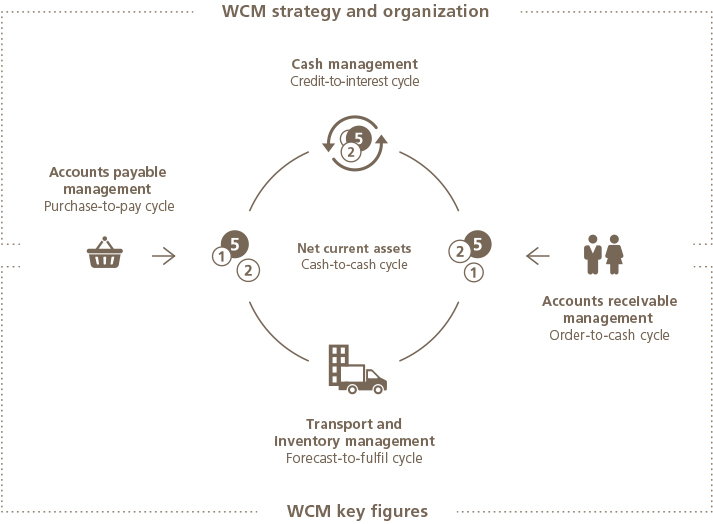

A focal point for WCM is the cash-to-cash cycle. This describes the commitment period of cash and cash equivalents in the value creation process of a company – from paying suppliers to receiving payment from the customers. WCM comprises four areas:

– Order-to-cash cycle: accounts receivable management

– Forecast-to-fulfil cycle: transportation and inventory management

– Purchase-to-pay cycle: accounts payable management

– Credit-to-interest cycle: cash management

With our WCM solutions, companies improve their liquidity and optimize cash flow.

Adrian Brönnimann,

Head of Individual Customers

What is WCM?

Working capital refers to the non-interest-bearing capital of a company needed for day-to-day operations. A professional working capital management (WCM) solution reduces operating costs, freeing up capital. This improves the balance sheet, strengthens the credit standing and increases the value of the company.