Result

Solid annual result in the first year as a public limited company

In the first year following its conversion to a public limited company, Swiss Post generated Group profit normalized to take account of one-off items of 626 million francs. All four markets contributed to the good result.

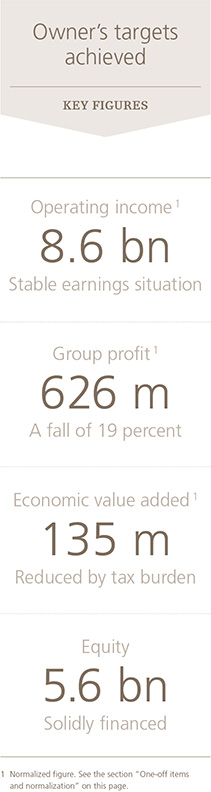

Since 2013, Swiss Post has been a public limited company wholly owned by the Swiss Confederation. In the first year following its conversion, the company generated Group profit normalized to take account of one-off items of 626 million francs (down 19 percent on the previous year: 772 million francs). The decline of 146 million francs is due to Swiss Post being fully taxed for the first time as a result of its new legal structure. At 8,575 million francs, normalized operating income was virtually unchanged from the previous year (8,576 million). Thanks to good cost management, which produced a reduction in operating expenses, the normalized operating profit (EBIT) rose to 911 million francs (previous year: 860 million francs). The operating profit margin (EBIT return) increased to 10.6 percent (previous year: 10.0 percent). Investments amounted to 453 million francs (previous year: 443 million) and were financed as before entirely from the company's own resources. Total assets grew moderately to 120.4 billion francs (previous year: 120.1 billion).

Swiss Post continues to require sound results throughout all Group units in order to ensure a high-quality universal service in the long term. At the General Meeting, the Board of Directors will propose paying a dividend of 180 million francs to the Confederation. As at 31 December 2013, total equity stood at 5.6 billion francs (before appropriation of profit).

Good results in all four markets

Swiss Post achieved good results in all four markets, with trends varying from market to market. The results of the individual Group units were influenced by the transition to charging for internal services. From 2013, all internal services are charged at market prices or full cost, replacing the partial cost rate linked to use of the post office network. Consequently, PostFinance, PostLogistics and PostMail make higher internal payments for services.

Growing challenges

The challenges facing Swiss Post are many and varied. Swiss Post will meet these challenges by following a strategy of long-term, gradual growth, by further optimizing costs in a socially responsible manner, and by pursuing market-driven pricing policies. Swiss Post intends to continue providing its customers with first-class services in all four markets. Strategically, it is focusing on the changes in customer behaviour and the new dynamics driven by technological change. As an integrated systems service provider, Swiss Post offers all-in solutions, reinforces and expands its core business with digital products, and generates growth with innovative services – including in new business areas.

One-off items and normalization

Swiss Post Ltd's (Group) financial result includes three one-off items in 2013. These did not lead to any adjustment of the previous year's figures. The one-off items and their financial impact are explained in detail on page 30 of the Financial Report. The non-consideration (normalization) of the three one-off items allows comparison with the previous year and provides an accurate representation of the current operating business performance.