Migration of payment transactions

Harmonizing payment transactions in Switzerland

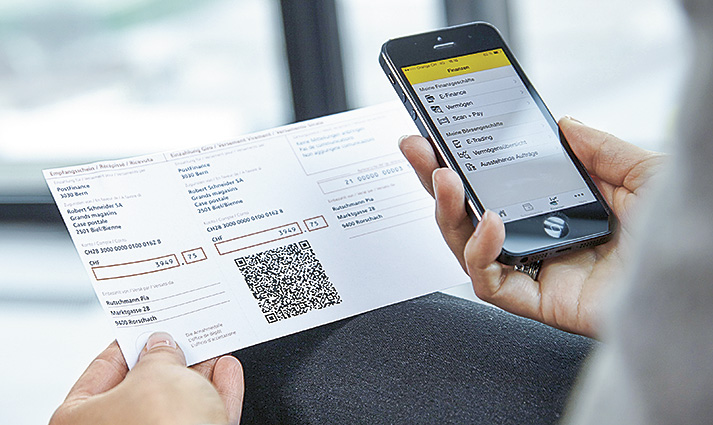

The new uniform slip has a QR code. This is better suited to smartphones than the current code line.

Payment transactions in Switzerland will be standardized over the next few years. As the number one for Swiss payment transactions, PostFinance is actively helping to shape the financial market.

Payment transactions are the core business of PostFinance – the centrepiece. PostFinance invests a lot of effort in providing reliable products at attractive conditions.

As a leading provider, PostFinance actively helps to design the structure of payment transactions in Switzerland. Today, there are around ten procedures and standards for credit transfers and direct debits in Switzerland, and at least seven different slip types. By 2018, these formats are to be converted in Switzerland to ISO 20022, and greatly simplified at the same time.

Uniform slip with QR code

In 2018, the new uniform slip will be launched and today's red and orange inpayment slips will become a thing of the past. By 2020 at the latest, there will be only one slip in circulation. This slip will include a QR code with all necessary information. The QR code will be more easily readable than the current code line and suitable for reading devices and smartphones. The QR code also includes all important payment information, such as recipient details and amount.

IBAN to replace postal account number

The procedure for credit transfers will be adapted to the SEPA rules and will be compulsory for all payment service providers in Switzerland. The IBAN will be the sole primary identification feature. The current postal account number will no longer be used.

Procedures for direct debit to be unified

As of autumn 2018, current procedures for direct debits will be migrated. For the harmonization, PostFinance is using the European standard as a guideline (SEPA Direct Debit in euros, standard ISO 20022). It will migrate the current Debit Direct to a solution for Swiss francs adjusted in line with these regulations.

Save time and reduce costs

Companies benefit from the standardized interfaces, formats, and the new uniform slip, and can further simplify and automate their payment transactions in Switzerland and abroad. ISO 20022 will lead to better data quality, lower error rates and reduce costs.

ISO 20022

refers to the international standard for electronic data exchange in the financial industry. It defines a uniform data format.

SEPA

stands for Single Euro Payments Area. Switzerland and over 30 other countries are members.

IBAN

stands for International Bank Account Number and is the international standard for presenting account numbers.

As a leading provider, PostFinance is actively helping to shape payment transactions in Switzerland.

Enrico Lardelli,

Head of Information Technology at PostFinance