Philippe Milliet, Myriam Meyer, Michel Gobet, Kerstin Büchel, General Secretary, Adriano P. Vassalli, Nadja Lang, Andreas Schläpfer, Peter Hasler, Susanne Blank, Marco Durrer

Remuneration policy

Determination of remuneration

Corporate risk, scope of responsibility and the Ordinance on Executive Pay are taken into account by the Board of Directors when determining the remuneration due to members of Executive Management. The Board of Directors has regulated the remuneration and fringe benefits for its members in the “BoD remuneration regulations”.

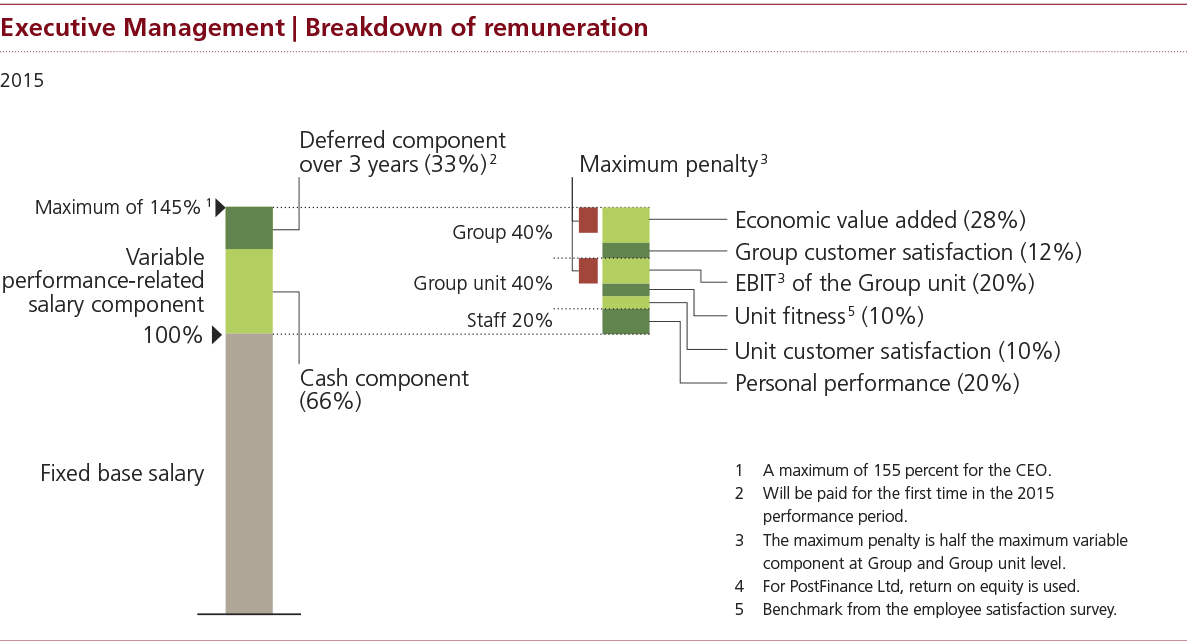

Remuneration for members of Executive Management is comprised of a fixed base salary plus a variable performance-related component. This may be a maximum of 45 percent of the gross annual base salary (a maximum of 55 percent in the case of the CEO). At Group level, the variable component is calculated from economic value added (28 percent) and Group customer satisfaction (12 percent). At Group unit level, a distinction is made between qualitative benchmarks (20 percent) and financial key figures (20 percent) such as EBIT. For PostFinance Ltd, return on equity is used instead of EBIT.

A penalty system may also be applied for calculating the variable salary component at Group and unit levels depending on the degree of target achievement. The maximum penalty represents half the maximum variable component.

All three performance levels are taken into account (Group, Group unit and individual performance) to determine whether the threshold for the variable component has been reached. The variable component is only paid on reaching this value. There is a penalty area below the threshold for the variable salary. If a penalty applies, the variable salary component is reduced accordingly. One-third of the variable salary component that is actually awarded is booked to a special account for variable remuneration. One-third of the balance of this account is paid out from the third year. The remaining two-thirds of the variable salary component are paid out directly. If, as a result of the penalty system, a negative variable salary component is awarded, this negative amount is booked to the account for variable remuneration and the account balance is reduced accordingly.

Members of Executive Management also receive a first-class GA travelcard, a company car, a mobile phone, a tablet computer and a monthly expense account. Swiss Post also pays the insurance premiums for a risk insurance policy. Individual bonuses may be paid to reward special personal contributions.

Neither the members of Executive Management nor persons closely linked to them received any additional fees, remuneration, guarantees, advances, credits, loans or benefits in kind during the financial year.

Both the base salary and the performance component are insured for members of Executive Management up to a maximum of 338,400francs in the Swiss Post pension fund (defined contribution plan); higher income is covered by a management insurance scheme (defined contribution plan). The employer contributes disproportionally to the contributions for employee benefits. Employment contracts are based on the Swiss Code of Obligations. Since 1 July 2010, the notice period for members of Executive Management has been six months. For members appointed before that date, the previous notice period of 12 months applies. No agreements on severance payments are in place.

Corporate risk is taken into account by the Board of Directors when determining the remuneration due to members of Executive Management.