Group result

Good result in increasingly difficult environment

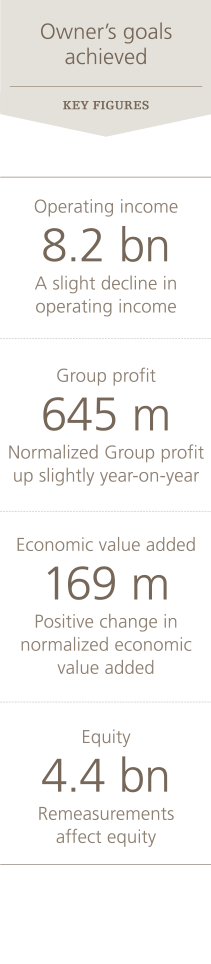

Swiss Post recorded a Group profit of 645 million francs in 2015 (previous year: 638 million francs). Operating profit (EBIT) stood at 823 million francs (previous year: 803 million francs). The slight increase is mainly due to changes in the carrying amounts in the financial services market. The economic environment and the ongoing low interest situation remain challenging.

For the year 2015, Group profit stood at 645 million francs, which represents an increase of 7 million francs.

At 823 million francs, operating profit (EBIT) is 20 million francs up on the previous year's figure. This was mainly due to book gains on financial investments, non-recurring book losses from the prior-year period and sharply higher net trading income in the financial services market following the lifting of the minimum euro exchange rate. Operating income was down 147 million francs to 8,224 million francs (previous year: 8,371 million francs).

Total assets fell from 124.67 billion francs to 120.33 billion francs.

One-off items and appropriation of profit

Swiss Post's financial result includes one-off items for the year 2015. However, they did not lead to any adjustment of the prior-year figures. The non-consideration (normalization) of these one-off items allows comparison with the previous year and provides an accurate representation of the current operating business performance. In 2015, Group profit, operating profit and operating expenses are affected by normalization (see also Financial Report, page 34).

At the General Meeting, the Board of Directors will propose paying a dividend of 200 million francs to the Confederation. As at 31 December 2015, Group equity stood at 4.39 billion francs (before appropriation of profit).

Ongoing development focused on demand and affordability

Swiss Post intends to continue providing its customers with first-class services. To enable investment in infrastructure and innovation and allow it to develop in the long term using its own resources, Swiss Post depends on solid profits. While letters, which are protected by a partial monopoly, are faced with ongoing volume declines, the pressure on margins for parcels is rising. Changing technologies are changing customer behaviour fundamentally. Swiss Post must therefore continue to consistently develop its access points and services and adapt them to the needs of its customers while at the same time also creating an affordable infrastructure.