Group result

Situation at PostBus impacts 2017 Group result

Swiss Post maintained a profit, albeit lower.

Alex Glanzmann

Head of Finance and Member of Executive Management

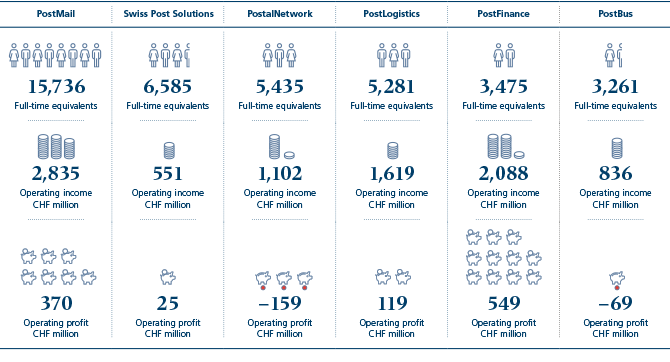

In the year under review 2017, Swiss Post generated profit of 420 million francs. In the previous year, this figure was 558 million francs. The solid annual result was significantly influenced by the irregular accounting practices in segment accounting at subsidiary PostBus Ltd, which were first reported in February. The previously announced reimbursement of around 78 million francs of excess compensatory payments received between 2007 and 2015 and a provision for the unresolved situation for 2016 and 2017 weighed on the result. Operating profit (EBIT) totalled 630 million francs last year, down 74 million francs year-on-year. Operating income fell to 7,987 million francs. Swiss Post nevertheless managed to record a profit in its core business.

The market environment for Swiss Post Group remains challenging: volumes of addressed letters are falling, pressure on prices in the logistics market is increasing and over-the-counter transactions continue to decline. Nevertheless, the result improved in both the letter and parcel markets. The deficit at PostalNetwork was reduced thanks to operational measures. At PostFinance, one-off effects such as the sale of two equity portfolios and reversals of impairment on financial assets helped bolster the result.

PostBus to repay excess subsidies in full

As previously communicated in early February 2018, PostBus received excess compensatory payments between 2007 and 2015 due to irregular reclassifications. PostBus will reimburse the claimed amount – a sum of 78.3 million francs – to the Confederation and cantons. Accordingly, its operating result stands at –69 million francs. In addition, a provision amounting to 30 million francs will be made for the years 2016 and 2017. The effective amount will be determined as part of the clarification of the new model in the coming weeks.

Investment, universal service and appropriation of profit

Investment is of vital importance for Swiss Post. It is the only way for the company to maintain its competitive edge and remain fit for the future. In the past year, Swiss Post capitalized investments of around 400 million francs for the preservation of its capital assets, development of its core business and expansion of new business. PostFinance is investing in projects such as a new core banking system, which will come into operation on 1 April 2018. In 2017, Swiss Post financed the costs of the universal service – as well as all investments – from its own resources.

As at 31 December 2017, consolidated Group equity stood at 6,613 million francs. At the General Meeting, the Board of Directors will propose paying a dividend of 200 million francs to the Confederation. This means that Swiss Post again created added value for Switzerland, customers, employees and its owner in 2017.

Profound transformation required

One year ago, Swiss Post began an extensive transformation process designed to tackle the rapid developments in digitization and the associated customer requirements in the long term. In the first year of implementation, the company not only defended its leading market positions in all of its core businesses, but also successfully expanded them. It will continue to pursue its chosen path in the coming years and to adapt its services to customer behaviour. Efficiency improvements and targeted cost management throughout the company are an ongoing project and a key factor in achieving a good operating result. Finally, Swiss Post is also faced this year with the task of conducting a fundamental analysis of the situation at PostBus and adapting strategy where necessary.